Heat at the center: SAGST publication implicit in new edition

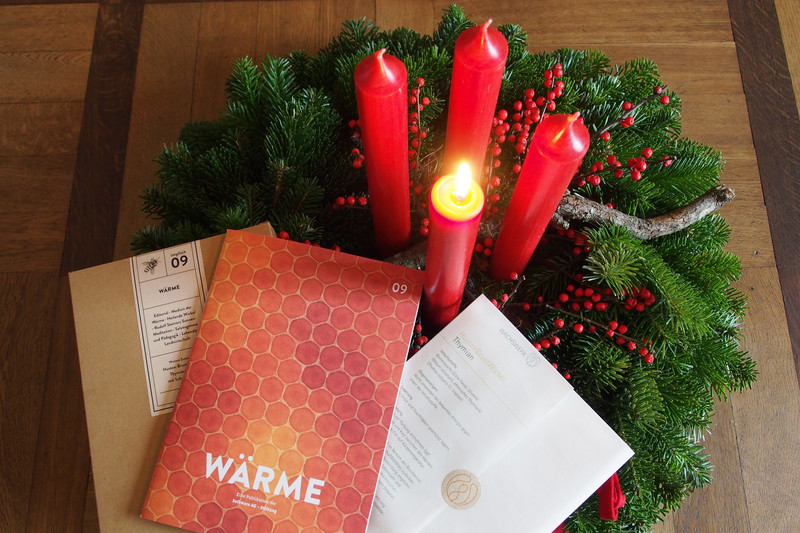

The Software AG Foundation (SAGST) has published the ninth issue of its publication implizit . The magazine is dedicated to the topic of "warmth" - a basic human need that extends far beyond the physical and is effective in social, emotional and spiritual processes. The packaging in the style of a historical medicine box underlines the magazine's claim to carry healing impulses for perception, reflection and inner orientation into the present.

It approaches the topic from different angles - from anthroposophical medicine and educational approaches to agriculture - on around 40 pages and shows: Warmth is far more than temperature or a state of comfort. It can stimulate self-healing, promote resilience and bring people into balance. In education, it creates a sense of security that protects children, provides emotional nourishment for young people and helps older people to rest. Warmth is understood here as affection - as an attitude that enables growth and strengthens connections. Warmth also has a visible effect in biodynamic agriculture by penetrating the soil and plants, causing germs to break open and fruit to ripen.

The honeycomb is a central design motif. It symbolizes care, cooperation and mutual responsibility and stands for the bee colony, which survives the winter through collectively generated warmth. An enclosed beeswax wrap allows readers to experience warmth not only in their thoughts but also in their senses.

"Charity - both financially and in the figurative sense - is particularly important to us as a foundation," emphasizes Peter Augustin, member of the SAGST Executive Board. "It shapes our image of humanity and our funding practice. Because warmth creates spaces in which people can come together and ideas can develop. With this publication, we want to consciously cultivate this attitude in a time of increasing social coldness."

implizit 9 is aimed at anyone looking for inspiration for mindful living and cooperation. It is available as a free publication to order at info(at)sagst.de and, with Rudolf Steiner's sun meditation printed in the middle of the magazine, invites readers to rediscover and cultivate warmth as a central interpersonal quality.